For a very long time, Indian agriculture has been heavily reliant on physical markets and local dealers for agri inputs. The system resided well for a number of years but it did create access, pricing clarity, and information gaps. Agritech is not here to take over the farming knowledge but to be a layer of support that helps farmers to make better decisions when buying inputs and at the same time, they take less risks and save time.

Farmers today cannot simply depend on the nearest store for their agricultural input needs. Digital platforms are changing the way farmers compare products, learn usage, and plan purchases, especially when their crops are at a critical stage.

What is Agritech?

Agritech means using digital technology throughout the farming process. In agri input buying, it is all about making it easier for farmers to find, assess, and buy seeds, fertilizers, crop protection products, and equipment. These platforms make use of commerce and information together, thus giving farmers the opportunity to get out of the messy land of guesswork and to rely on structured details.

Farmers are no longer dependent only on verbal advice and can also check product specifications, compatibility, and pricing on their phones. This change is not just a concept; it is a result of increased smartphone penetration and cheap internet in rural India.

Common Challenges in Agri Input Buying Before Digitization:

Before agritech platforms were widely available, farmers had to deal with a series of problems that kept coming back:

- Limited product choices restricted to local dealer stock

- Price variations with little transparency or comparison

- Inconsistent advice on dosage and application

- Travel time and opportunity cost to source multiple inputs

Industry sources put the percentage of small and marginal farmers who relied on one retailer for most of their inputs at close to 60 percent. Such dependence raised the likelihood of excessive payment or receiving inappropriate recommendations, thus having a direct impact on the farmers’ productivity and cost efficiency.

The Rise of Agritech Platforms in India:

India has seen agritech adoption grow steadily over the last 10 years. The number of rural internet users has crossed 350 million and this has changed the entire information flow in villages. Farmers who were dependent on word of mouth are now accessing product data, advisory content, and delivery services through mobile apps.

Key Drivers of Agritech Adoption

Several factors have accelerated this transition:

- Rising input costs pushing farmers to compare options

- Increased smartphone penetration in rural areas, now above 65 percent

- Familiarity with digital payments and mobile-based services

- Government-led digital awareness programs

These drivers have created an environment where digital input buying feels less risky and more routine.

How Agritech is Solving Supply Chain Inefficiencies

Traditional agri input supply chains are often riddled with multiple intermediaries, which not only escalate the costs but also increase the waiting time. However, the agritech platforms have revolutionized this process by providing a direct link between the farmers and the authorized sellers as well as the distributors. Not only does the inventory become more visible, but the delivery timelines also get fixed and it becomes quite easy to tackle the shortage in any region.

Research shows that well organized digital supply chains have the potential to bring down the procurement, related costs by 10 to 15 percent. This is indeed a hefty amount of money saved for farmers who are very much price conscious.

AgriBegri: A Disruptive Force in Agri Input Buying

Among India’s growing agritech platforms, AgriBegri has built a model centered on access, clarity, and reliability rather than just transaction volume.

Company Overview and Vision:

AgriBegri was born out of the idea that farmers deserve hassle, free access to authentic agricultural inputs accompanied by straightforward and useful information. To this end, the platform is centered around doing away with any confusion that may arise during purchasing by interrelating trustworthy products, well organized listings, and gaining support from agronomy experts.

In this way, AgriBegri does not merely run a market for inputs but rather aligns itself as a welfare instrument for consumers who are able to make input decisions based on the right information.

Unique Value Proposition of AgriBegri:

The AgriBegri model stands out because it addresses common farmer concerns at the same time:

- Verified sourcing to reduce counterfeit risk

- Transparent pricing visible before purchase

- Information-driven listings that support correct usage

This combination shifts buying behavior from habit-based choices to need-based decisions.

Features and Services Offered by AgriBegri:

AgriBegri’s platform design reflects real field-level challenges and attempts to solve them digitally.

Product Categories: Seeds, Fertilizers, Pesticides, Equipment

The platform aggregates a wide range of agri inputs in a single location. Farmers are able to procure seasonal seeds, nutrient products, crop protection solutions, and equipment in a seamless manner without the need to switch between different suppliers. For those who are researching options on the internet, agriculture input products serve as a source of consolidation in terms of availability and choice, particularly during periods of high demand.

Price Transparency and Direct-to-Farmer Sales Model

One of the largest changes that digital platforms have brought about is price visibility. AgriBegri makes product prices very clear, thus the consumers are less dependent on negotiation and guesswork. This openness allows farmers to plan their input budgets with a lot more accuracy, especially when input costs can make up a very high proportion of the total expenses of cultivation.

Multilingual Support and Rural Accessibility

Language is still a big barrier for people to go online. AgriBegri has many Indian languages so that people who are buying digital things for the first time can use the platform without any trouble. Their mobile first strategy also makes the application user friendly even for farmers who have a simple smartphone and are not very tech savvy.

Impact on Farmers and Rural Markets:

The influence of agritech platforms extends beyond convenience. They are gradually reshaping cost structures, knowledge access, and buying confidence in rural markets.

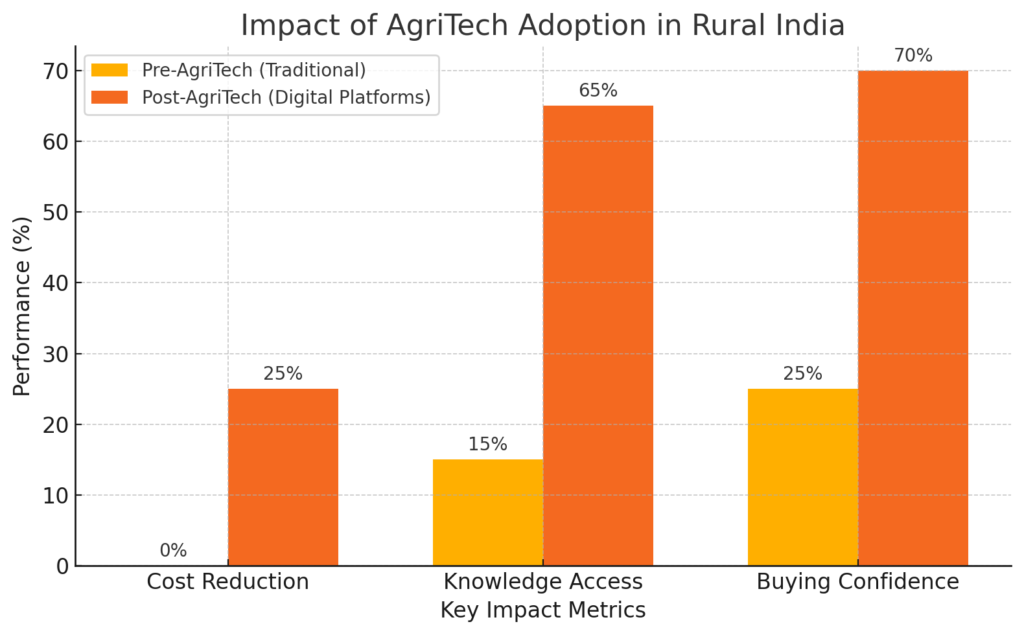

Here’s a clear bar chart comparing key impact metrics before and after AgriTech adoption in rural India, showing sharp improvements in cost reduction, knowledge access, and buying confidence after digital integration.

Cost Savings and Improved Access

Removing layers between the producer and consumer, farmers can access competitive prices and a wider product range. Studies on rural commerce indicate that farmers who use digital input platforms save on average between 8 and 12 percent per season. Agritech platforms drive 25-35% income gains for farmers through significant input cost reductions. Marketplaces within these platforms contribute around 10% direct savings by streamlining procurement and eliminating intermediaries.

Digital Literacy and Mobile Penetration Benefits

Using agritech platforms cultivates functional digital literacy. Farmers figure out how to compare labels, track orders, and understand product details. Eventually, this familiarity leads them to the use of other digital services like advisory tools and financial platforms.

Real Farmer Case Studies Using AgriBegri

Adoption narratives tend to focus on utility aspects first and foremost, rather than on the attraction of the technology itself. AgriBegri, a platform local farmers are highly vocal about, is mainly credited for saving them the time they would have spent going to the market, ensuring the availability of products, and getting more reliable information. Time and again they say that if they can get their inputs during the most critical stages of a crop then any other benefit just doesn’t matter.

“In agriculture, access to the right input at the right time matters as much as the input itself.”

Comparison with Traditional Retail and Other Agritech Platforms:

Understanding AgriBegri’s role requires looking at how it differs from both offline retail and peer platforms.

Traditional Input Retail vs AgriBegri Model

Conventional retail is largely based on personal relationships and the availability of local stock. Although trust is a factor, product choice and transparency are still quite limited. The AgriBegri model not only changes scarcity to selection but also adds trust to verifiable information, thus making decisions, making more confident.

Competitive Benchmarking: DeHaat, AgroStar, Gramophone

India’s agritech ecosystem is rich with platforms like DeHaat, AgroStar, and Gramophone. A few concentrate on providing end, to- end farm services or advisory, led models. However, AgriBegri is an e-commerce first platform that is powered by agronomy, aligned content.

Future Outlook of Agritech in Agri Input E-commerce:

Agritech’s next phase will depend on how platforms scale while maintaining trust and reliability.

Trends in Agri Input Digitization

Key trends shaping the future are personalized recommendations, regional demand forecasting, and improved logistics integration. India’s agritech market is expected to grow at a compound annual rate of more than 12 percent. The growth will be mainly driven by digital input and advisory services.

Scalability Challenges and Infrastructure Needs

Growth brings its own set of challenges. Delivering the last mile to remote areas, incurring logistics costs and maintaining quality are some of the issues that require continuous investment. Platforms must walk the tightrope between expanding and being consistent in order to maintain the trust of farmers.

Policy Support and Regulatory Landscape

Supportive policies around digital agriculture, traceability, and e-commerce compliance will influence platform growth. Clear regulations can strengthen confidence in online input buying and encourage wider adoption.

Where This Transformation is Heading:

Agritech is gradually reshaping farmers’ practices of buying agricultural inputs. Digital platforms such as AgriBegri are examples of how digital systems can not only simplify complicated markets but also be based on the needs of real farmers. With the rise of adoption, the emphasis will not be on access anymore but rather on making buying decisions that are smarter and more informed, which in turn will allow farmers to be able to plan better, season after season.