Back in 2017, two visionaries Siddharth Dialani and Sai Gole set out on an ambitious mission. They dreamt of bringing the power of Artificial Intelligence to Indian farmlands, helping small and mid-sized farmers make smarter decisions, increase productivity, and ultimately improve their incomes.

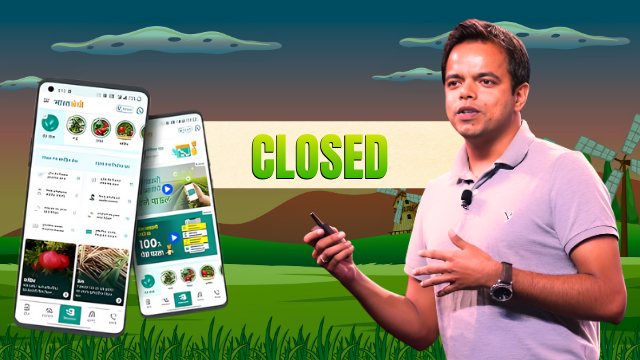

That dream took shape as BharatAgri, an agritech startup that promised AI-led farm advisory and agri-input e-commerce solutions. Within just a few years, it became one of the most talked-about names in the agri-innovation space. With over a million registered users, BharatAgri was building hope one crop at a time.

The Promise of Smart Farming:

In its early years, BharatAgri was seen as a game-changer. It used AI models to provide personalized crop calendars, soil health advice, and input recommendations to farmers. For the first time, small farmers could access scientific insights directly on their mobile phones, a concept that felt revolutionary.

The platform grew fast. The team expanded. And investors took notice. BharatAgri raised $6.5 million in 2021 and another $6 million in 2023, backed by Arkam Ventures, India Quotient, and Omnivore, some of India’s top agritech investors.

The momentum was strong, and the dream seemed unstoppable.

When Growth Meets Reality:

But behind the scenes, the story was getting complicated.

Despite early adoption, BharatAgri faced challenges that many Indian agritech startups know too well: high customer acquisition costs, low repeat orders, and a fragmented market with limited digital literacy among farmers.

Revenue remained modest. In FY24, BharatAgri earned around ₹5.37 crore, slightly down from the previous year. But losses grew sharply from ₹17.89 crore in FY23 to ₹22.04 crore in FY24, with total expenses touching ₹27 crore.

The burn rate was unsustainable. Salaries, marketing campaigns, and operations began to weigh heavily on the startup’s finances.

The Funding Winter Hits Hard:

As BharatAgri searched for fresh capital, the timing couldn’t have been worse. The agritech funding landscape in India had cooled dramatically.

In 2022, agritech startups raised $802 million. But just a year later, that number had fallen by nearly 78% to $178 million, and in the first half of 2025, the figure plunged further to $96 million.

Investors, once enthusiastic about direct-to-farmer models, were now turning toward B2B agri-supply chains, logistics, and downstream processing sectors seen as more sustainable and scalable.

Despite BharatAgri’s attempts to pivot and optimize costs, funding talks went silent. One by one, team members were let go. And by late 2025, BharatAgri began quietly winding down operations.

A Reflection on the Agritech Challenge:

BharatAgri’s closure isn’t an isolated story. It joins the list of once-promising agritech names Fraazo, Otipy, Deep Rooted, ReshaMandi that also had to shut down despite raising significant capital.

Each of these startups shared a common challenge: balancing innovation with sustainable unit economics. While their ideas addressed real farmer needs, their business models often couldn’t withstand the high costs of rural operations and thin profit margins in the agri-value chain.

The Legacy Lives On:

Even as BharatAgri’s journey comes to a close, its impact remains. It introduced thousands of farmers to the idea that data and AI could improve their livelihoods. It inspired dozens of agritech founders to dream bigger, to innovate harder, and to keep reimagining how technology can serve the backbone of India and its farmers.

In many ways, BharatAgri’s story isn’t one of failure, it’s a story of bold ambition, tough lessons, and the evolving reality of building sustainable innovation in Indian agriculture.

A Note to Future Agripreneurs:

The fall of BharatAgri is a reminder that technology alone isn’t enough; it must walk hand-in-hand with economic sustainability, farmer trust and ground-level execution.

For India’s next generation of AgriStartups, the road ahead is still bright but it demands patience, deep farmer engagement, and creative business models that can survive the long harvest.